kansas vehicle sales tax rate

Or less 4225. Revised guidelines issued October 1 2009.

States Without Sales Tax Article

There are also local taxes up to 1 which will vary depending on region.

. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax. Kansas has a 65 statewide sales tax rate but also has 531 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1979 on top of the state tax.

With local taxes the total sales tax rate is between 6500 and 10500. There are also local taxes up to 1 which will vary depending on region. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums dependent on the companys affiliation.

Kansas offers several electronic file and pay solutions see page 17. When using the Property Tax Check keep in mind that our office will pro-rate your property tax from your. This table shows the total sales tax rates for all cities and towns in Wyandotte.

Or the jurisdiction name then click Lookup. 679 rows 2022 List of Kansas Local Sales Tax Rates. The Tax Calculator should only be used to estimate an individuals tax liability.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. This publication will address whether sales or compensating use tax is due on a particular vehicle. Code or the jurisdiction name then click Lookup Jurisdiction.

Tangible Personal PropertyÃÂ and Labor ServicesÃÂ ÃÂ are both taxable in Kansas. Motor vehicle dealers and other retailers will find our Publication KS-1520. 775 for vehicle over 50000.

While every attempt is made to provide you with. The max combined sales tax you can expect to pay in Kansas is 115 but the average total tax rate in Kansas is 8477. This means that depending on your location within Kansas the total tax you pay can be significantly higher than the 65 state sales tax.

Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. The total sales tax rate in any given location can be broken down into state county city and special district rates. Car tax as listed.

Furthermore labor is also taxable in Kansas so if you install or. Or more 5225. BACK COVER 3 KANSAS SALES TAX This publication has been developed.

In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. The Tax Calculator is not intended to serve as an online. If you are a retailer in Kansas you will have to pay taxes on sales rentals or leases on personal property.

For the property tax use our Kansas Vehicle Property Tax Check. Sales Tax on Vehicle Sales. If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or call the departments Taxpayer Assistance Center at 1-785-368-8222.

Use this publication as a supplement to Kansas Department of Revenues basic sales. How to Calculate Kansas Sales Tax on a Car. 635 for vehicle 50k or less.

What transactions are generally subject to sales tax in Kansas. Kansas has a 65 sales tax and Wyandotte County collects an additional 1 so the minimum sales tax rate in Wyandotte County is 75 not including any city or special district taxes. 425 Motor Vehicle Document Fee.

Department of Revenue guidelines are intended to help you become more familiar with Kansas tax laws and your rights and responsibilities under them. The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income tax liability. Select the Kansas city from the list of popular cities below to see its current sales tax rate.

The company can claim either the 15 percent credit or up to the 1125 percent whichever is less. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. And Statistical Reports Address Tax Rate Locator Web.

Kansas has recent rate changes Thu Jul 01 2021. For vehicles that are being rented or leased see see taxation of leases and rentals. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. 31 rows The state sales tax rate in Kansas is 6500. This page covers the most important aspects of Kansas sales tax with respects to vehicle purchases.

Sales and Use Tax Document Number. Withholding Tax returns electronically. Lowest sales tax 55 Highest sales.

The Kansas Retailers Sales Tax was enacted in 1937 at the rate of 2 increasing over the years to the current state rate of 650. Local tax rates. 200 1937 400 1986 530 2002 650 2015.

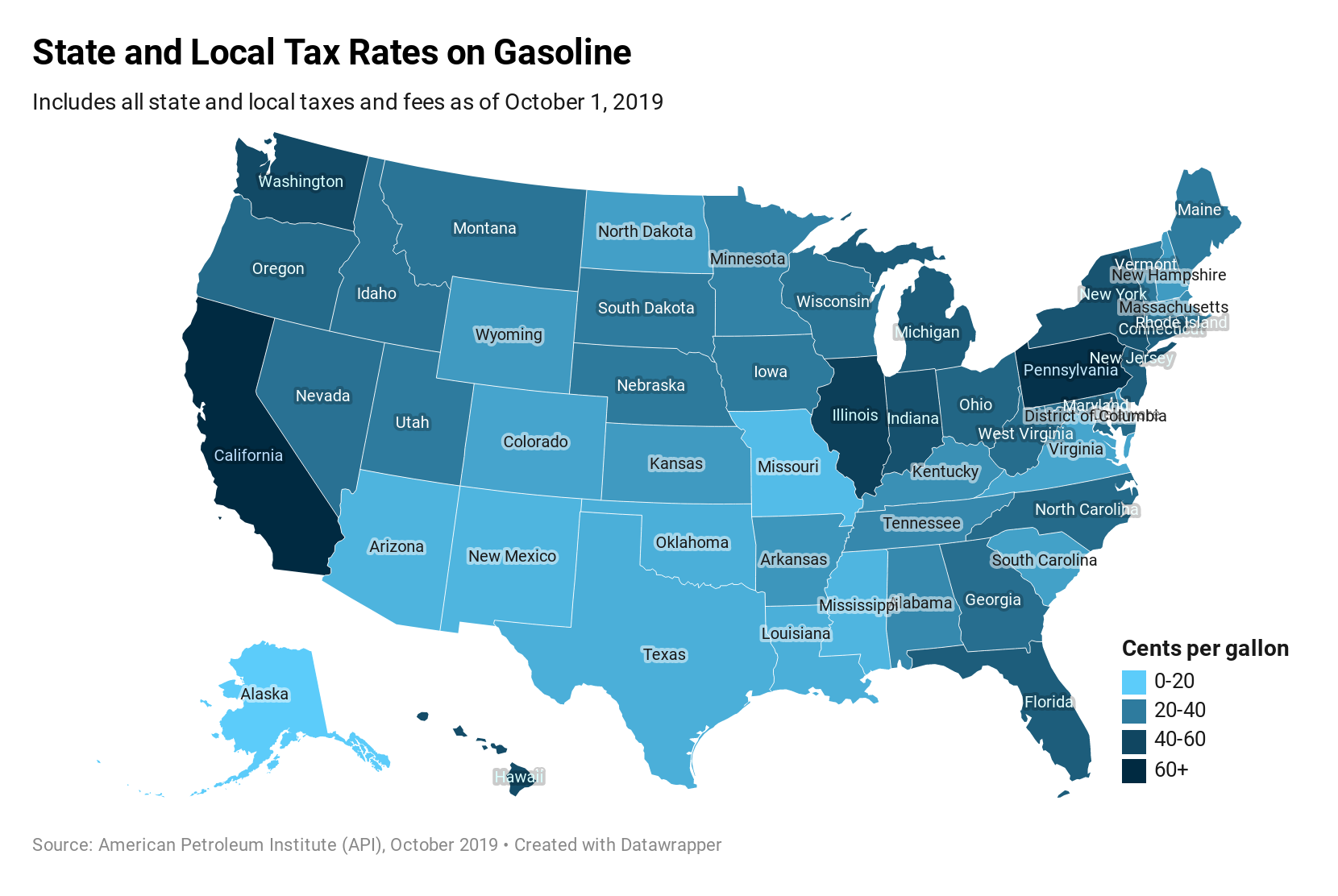

By County Income Sales Vehicle Property and Real Property Taxes and Per Capita-- 12. Tax Publication KS-1510 Kansas Sales and Compensating Use Tax. Comparison of Kansas and Selected States Various Tax Rates - January 1 2020 Beer Per Gallon Wine Per Gallon Cigarette Per Pack Motor Fuel Gasoline Per Gallon Colorado.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Motorized Bicycle 2000. The base state sales tax rate in Kansas is 65.

The minimum is 65.

What S The Car Sales Tax In Each State Find The Best Car Price

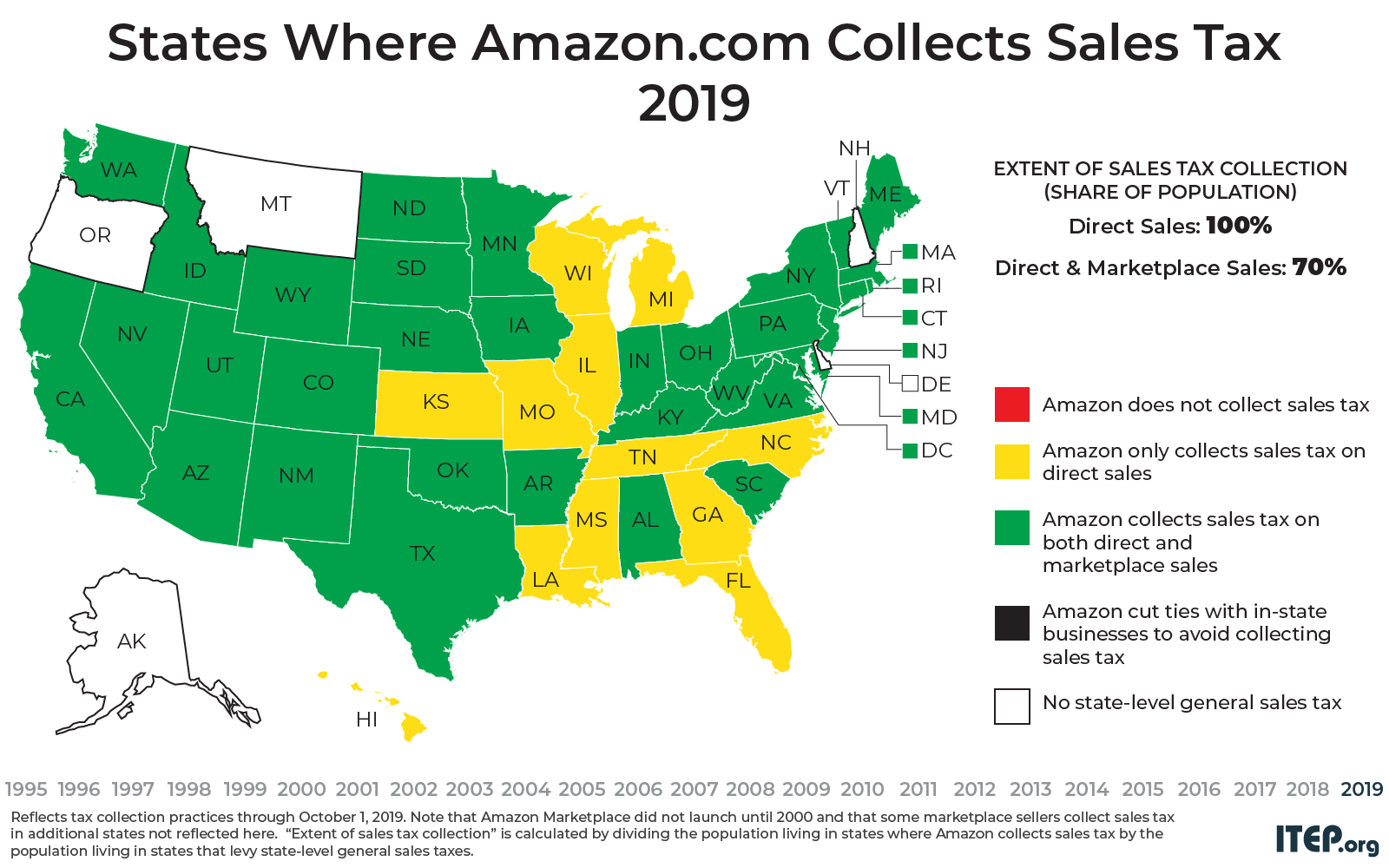

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Tax On Cars And Vehicles In Kansas

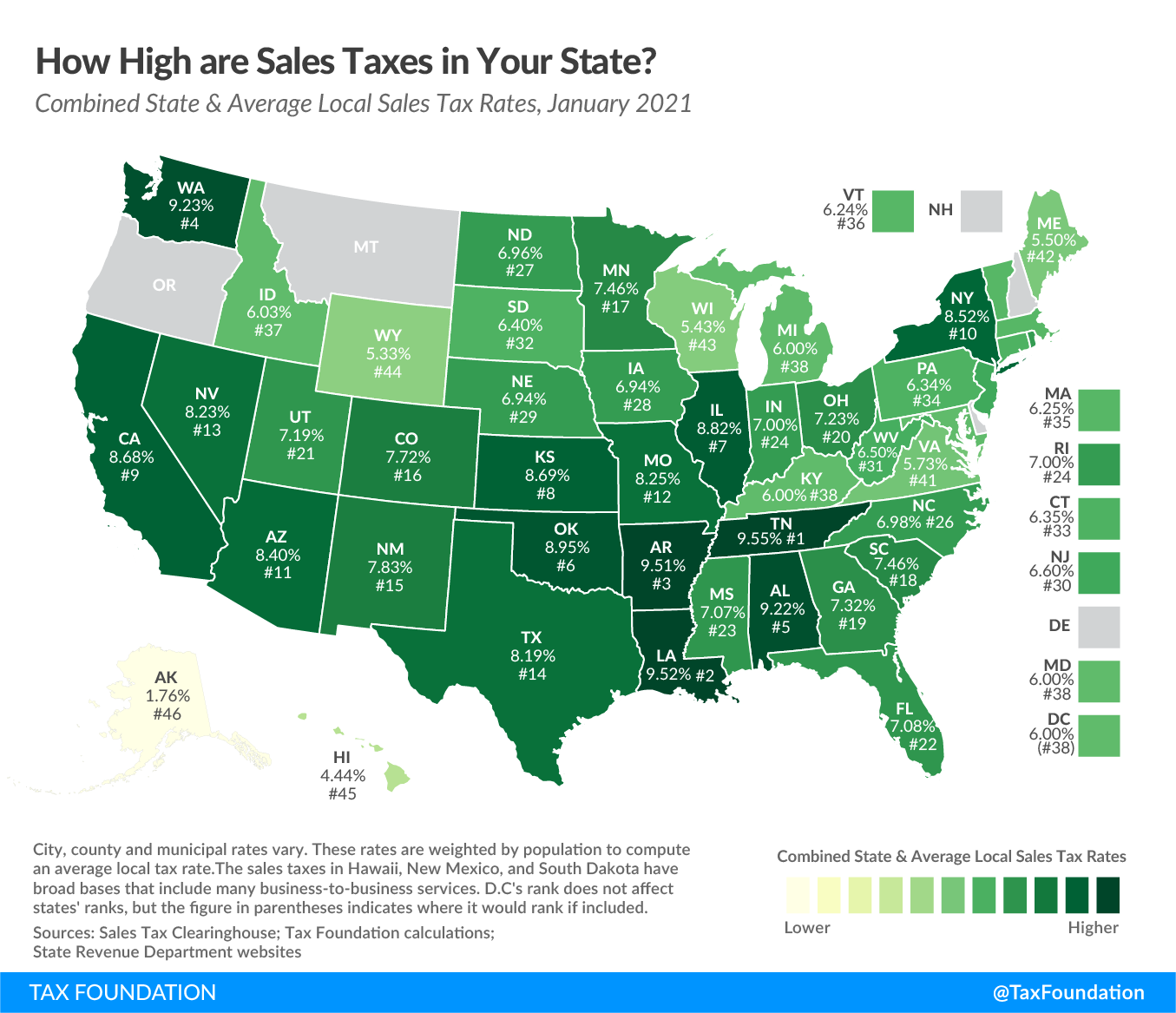

States With Highest And Lowest Sales Tax Rates

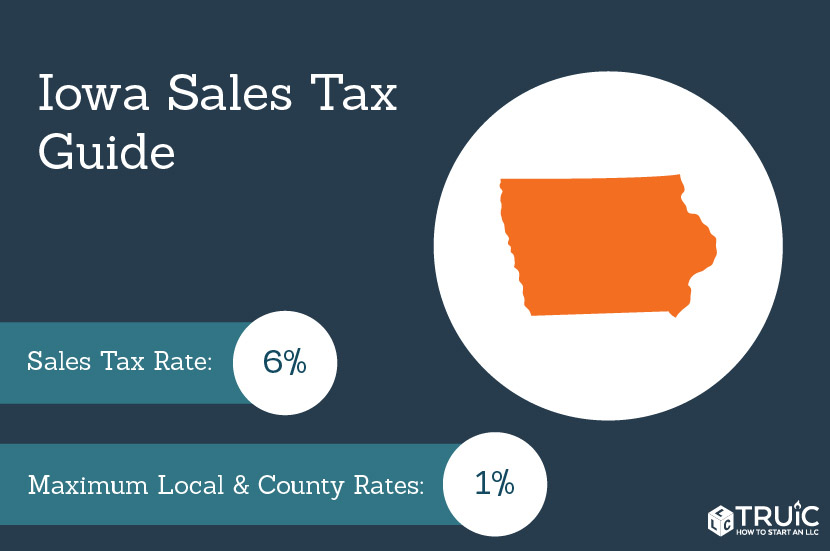

Iowa Sales Tax Small Business Guide Truic

Tax Rates Gordon County Government

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Sales Tax Definition What Is A Sales Tax Tax Edu

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Taxes In The United States Wikiwand

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Vehicle Sales Tax Deduction H R Block

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State And Local Sales Taxes In 2012 Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties